Automating Data Extraction From Bank Statements Using OCR Technology

Individuals and businesses use bank statements to keep track of their money, keep an eye on their transactions, and monitor tax-related activities. However, manually extracting data from these statements can be time-consuming, error-prone, and inefficient. Thanks to the advent of OCR Bank Statement, the automation of data extraction from these financial documents has become not only feasible but also incredibly valuable.

In this post, we’ll go over the challenges that organizations have when attempting to manually extract data from bank statements, as well as the benefits that come with an OCR Bank Statement System.

Understanding OCR Technology

Optical character recognition (OCR) technology is an advanced system that translates printed or handwritten text into computer-readable text data. It uses pattern recognition algorithms and artificial intelligence to identify and extract characters, words, and numerical values from images or scanned documents.

Over the years, OCR technology has advanced to the point that it is both precise and very effective. The most advanced OCR Bank Statement can decipher handwriting in cursive fonts and multiple languages. Since bank statements frequently include both printed and handwritten information, OCR is an effective technique for automating the extraction of this data.

Business Challenges in Manually Extracting Bank Statement Data

Data extraction from bank statements is essential for businesses, as it entails capturing and organizing financial data for accounting, auditing, and financial analysis purposes. However, manually extracting data from bank statements can be a laborious and error-prone task. Here, we will discuss the challenges businesses encounter when performing this task manually.

- Time-Consuming Process: Time constraints are a major hindrance when it comes to manually extracting data from bank statements. Bank statements can be large documents with multiple transactions, and it can be time-consuming to manually copy and paste the data from each statement into accounting software or spreadsheets. For businesses with many bank accounts, this might be a substantial drain on personnel.

- Inefficiency and Inconsistency: Data input errors might occur because humans are fallible and don’t always enter data in the same way. This discrepancy makes it harder to analyze data and compile reliable financial reports.

- Human Error: Manual data entry makes room for human errors. Accounting mistakes can occur when employees misinterpret figures or overlook the specifics of transactions. Financial inconsistencies, tax filing challenges, and compliance issues are just a few of the many knock-on effects that can result from these sorts of mistakes.

- Handwritten Annotations: There may be signatures, comments, or annotations scrawled on some bank statements. Accurately extracting handwritten information can be a formidable challenge as handwriting recognition technology is still in its infancy.

- Increased Risk of Fraud: When data is extracted manually, it’s possible that numerous people will have access to sensitive financial details. More persons having access to sensitive financial data raises the possibility of data breaches and fraudulent actions.

- Limited Scalability: The number of bank statements and monetary transactions generated by a growing business naturally rises. Manual data extraction processes may struggle to keep up with this scalability, leading to further inefficiencies.

- Compliance and Audit Challenges: Compliance with financial regulations and audit requirements is crucial for businesses. Manual data extraction may not always ensure the accuracy and consistency needed to meet these regulatory standards, potentially resulting in legal and financial consequences.

Benefits of Automating Data Extraction from OCR Bank Statement

There are several ways in which using OCR bank statement software can improve the financial management and decision-making of both individuals and corporations. The primary benefits of OCR financial statements are as follows.

- Time Efficiency: Manually extracting data from bank statements can be a time-consuming process, especially for businesses with numerous accounts. Bank Statement OCR significantly reduces the time and effort required for this daunting task, allowing employees or individuals to focus on more value-added activities.

- Accuracy: Bank Statement OCR can attain nearly flawless accuracy in data extraction from these documents. Thus eliminating the potential for human errors, such as misinterpreting numbers or inputting data incorrectly.

- Cost Reduction: OCR Financial Statements reduces the need for dedicated staff to perform manual data entry tasks, which can lead to substantial cost savings for businesses. Additionally, it minimizes the risk of errors that can result in financial discrepancies or costly audits.

- Compliance and Security: OCR Bank Statement enhances compliance with financial regulations and auditing requirements through accurate and reliable data extraction. Automated systems can also provide strong security features to safeguard confidential financial data.

- Scalability: As businesses grow, the volume of financial data increases. Automated data extraction systems like OCR Bank Statement can easily scale to handle larger amounts of data without a significant increase in operational costs.

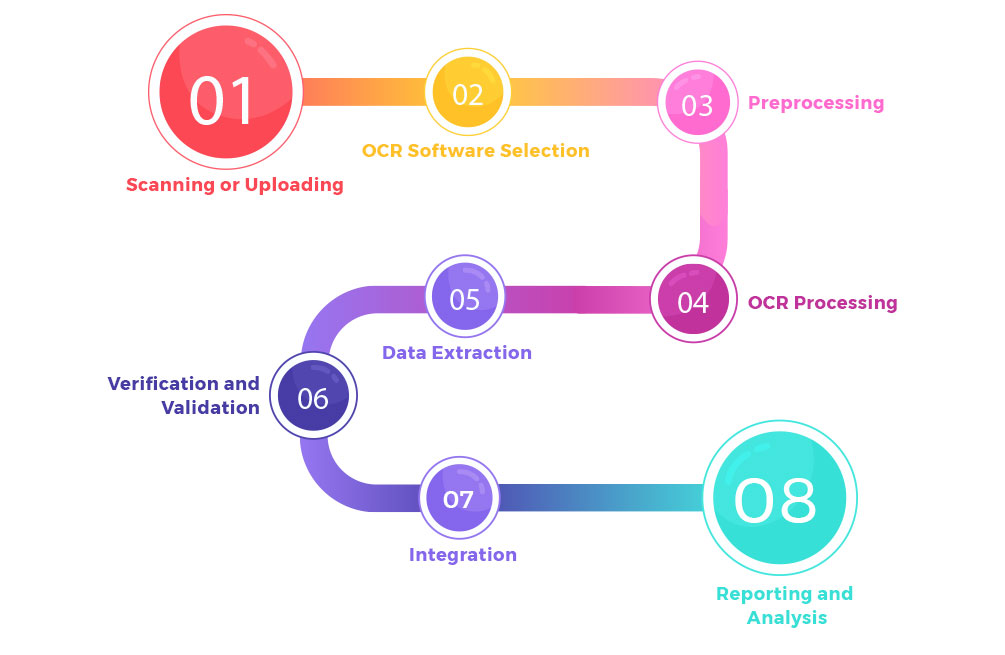

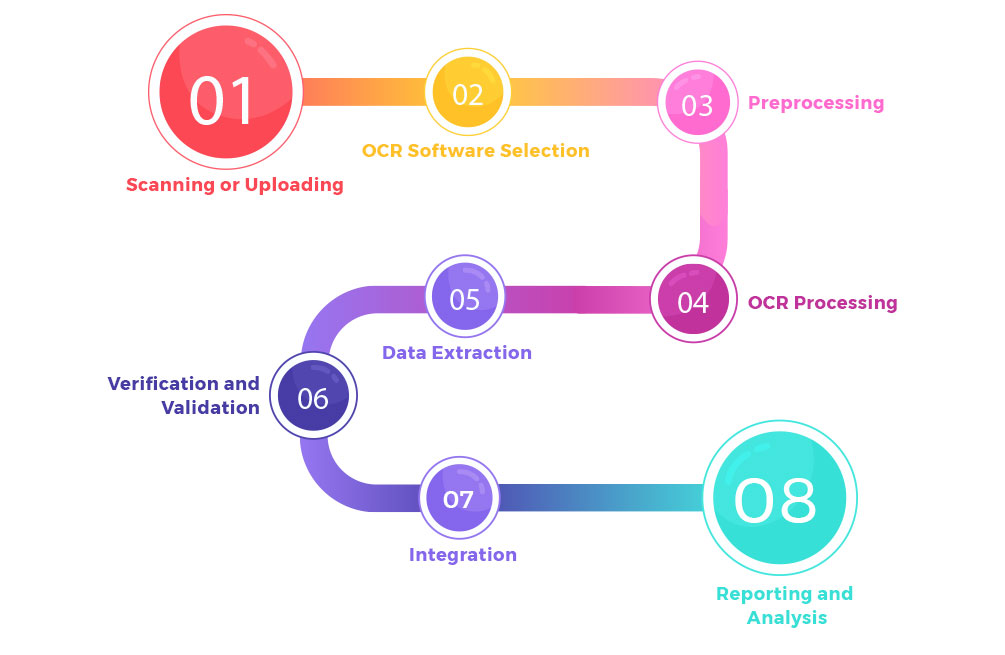

Steps to Automate Data Extraction from Bank Statements using OCR

OCR Bank Statements automates data extraction through a series of phases to provide a streamlined and accurate procedure. Follow these basic steps:

- Scanning or Uploading: OCR bank statements begin with scanning or uploading the documents into a digital system. For reliable OCR recognition, high-quality scans or digital images are required.

- OCR Software Selection: Choose an OCR software or solution that suits your needs. There are various OCR bank statement software options available, ranging from standalone desktop applications to cloud-based solutions. Consider factors such as cost, accuracy, and compatibility with your existing systems. Beyond Key OCR, which works with any existing document management system, is a great option for companies that deal with multilingual data.

- Preprocessing: Preprocessing the bank statements before running OCR will improve recognition accuracy. Scanned photos may need to be straightened, deskewed, and cleaned of noise and artifacts.

- OCR Processing: Run the OCR software on the preprocessed bank statements. The software will analyze the images, recognize text, and convert it into machine-readable data.

- Data Extraction: Extract the relevant data fields from the OCR-processed text. This includes information such as account numbers, transaction dates, transaction descriptions, and amounts.

- Verification and Validation: Put in place criteria of validation to make sure the information extracted is correct. For instance, verify that the sum of each transaction is the same and that the account numbers match the expected format.

- Integration: Integrate the OCR bank statement system with your financial software or database. This allows for seamless data transfer and updates in real-time.

- Reporting and Analysis: Make use of the information gleaned from the extraction for making reports, performing financial analysis, and keeping tabs on costs. This aids in understanding economic trends and making smart choices.

Conclusion

Automating data extraction from bank statements using OCR technology is a smart and efficient way to manage financial records for both individuals and businesses. The benefits of time savings, accuracy, cost reduction, compliance, and scalability make OCR financial statements a valuable investment. With an effective bank statement OCR, organizations can streamline their financial record-keeping processes and make better-informed financial decisions.

If you want to advance your business via the use of OCR bank statement software, Beyond Key is there to assist. We provide a variety of customized OCR services that can help you transform your business. Contact us today!!