Hack To Boost Your Insurance Business in 2023

Insurance is the best risk management instrument for Sheltering People and Organizations from financial risks brought on by various circumstances. While there is no way to compensate for the psychological and emotional harm, insurance at least makes up for the cash harm. Even if there are some uncertainties in life that you cannot control, insurance can undoubtedly assist you shift the financial risk involved.

Even though life is unpredictable, individuals plan for the future, set goals, and save money to achieve those objectives. Similarly, it’s critical to be ready for any unexpected incident. Insurance is a form of protection against all potential outcomes.

Quick Brief About Insurance

Insurance is a legal agreement between the insurance business company (the insurer) and the individual (the insured). Simply put, insurance is a means for transferring risk, allowing you to get coverage for any financial losses you may incur due to unplanned circumstances. In exchange for the premiums paid by the insured person, the insurance company (the insurer) agrees to pay for financial losses caused by insured eventualities. Risks ranging from your life to the usage of your mobile phones are covered by insurance. Protecting what you consider to be “important” to you is crucial in the end

Most people have some kind of insurance, whether it’s for their life, their home, or their car. But most of us don’t think much about what insurance is or how it works.

In a nutshell, insurance is a contract, which is shown by the policies, in which a policyholder gets financial security or compensation from an insurance company in case of losses. The company puts all of its clients’ risks together to make it easier for the insured to pay.

Insurance protects against both big and small financial losses caused by damage to the policyholder or their property or by being responsible for someone else’s damage or injury

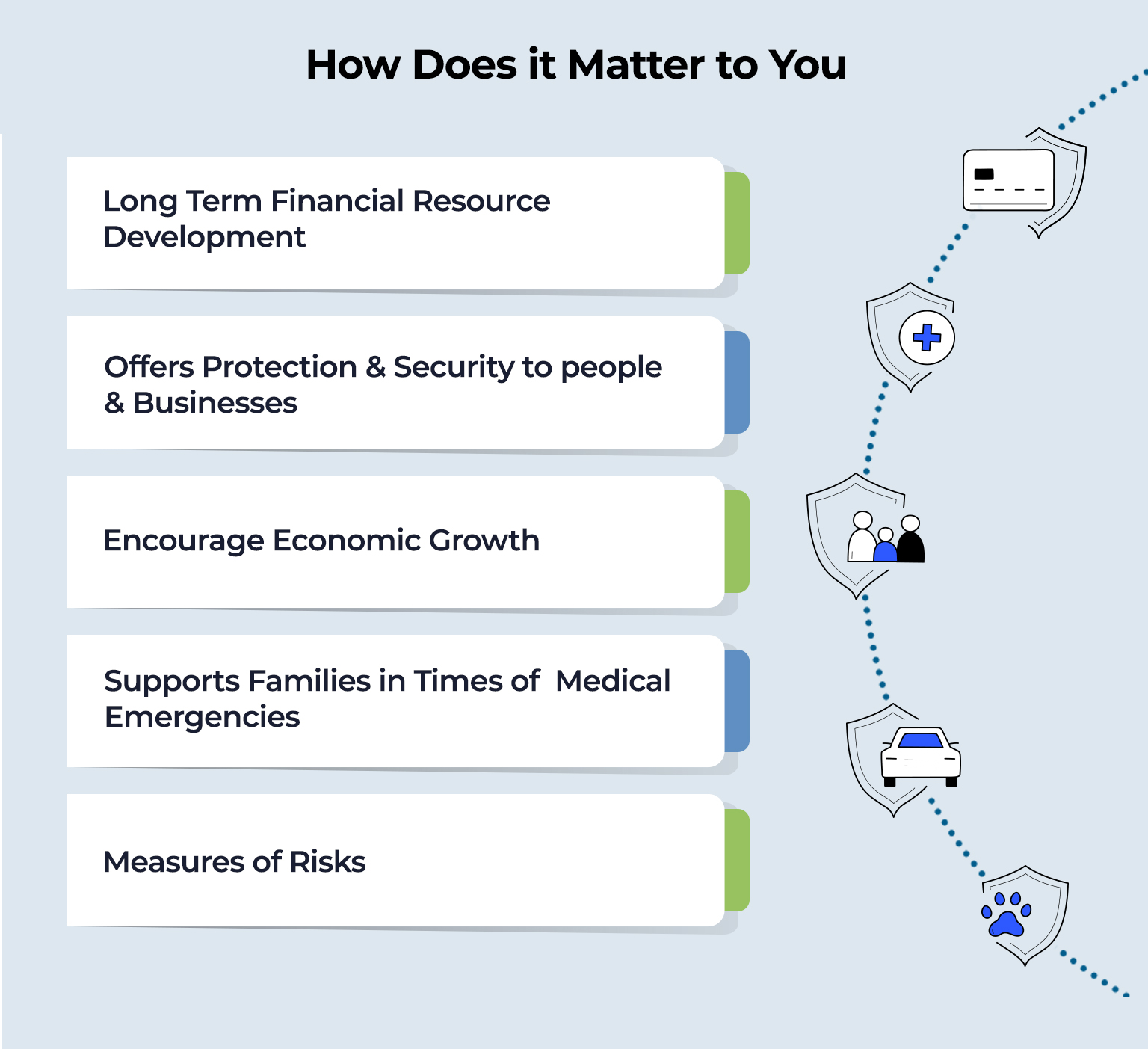

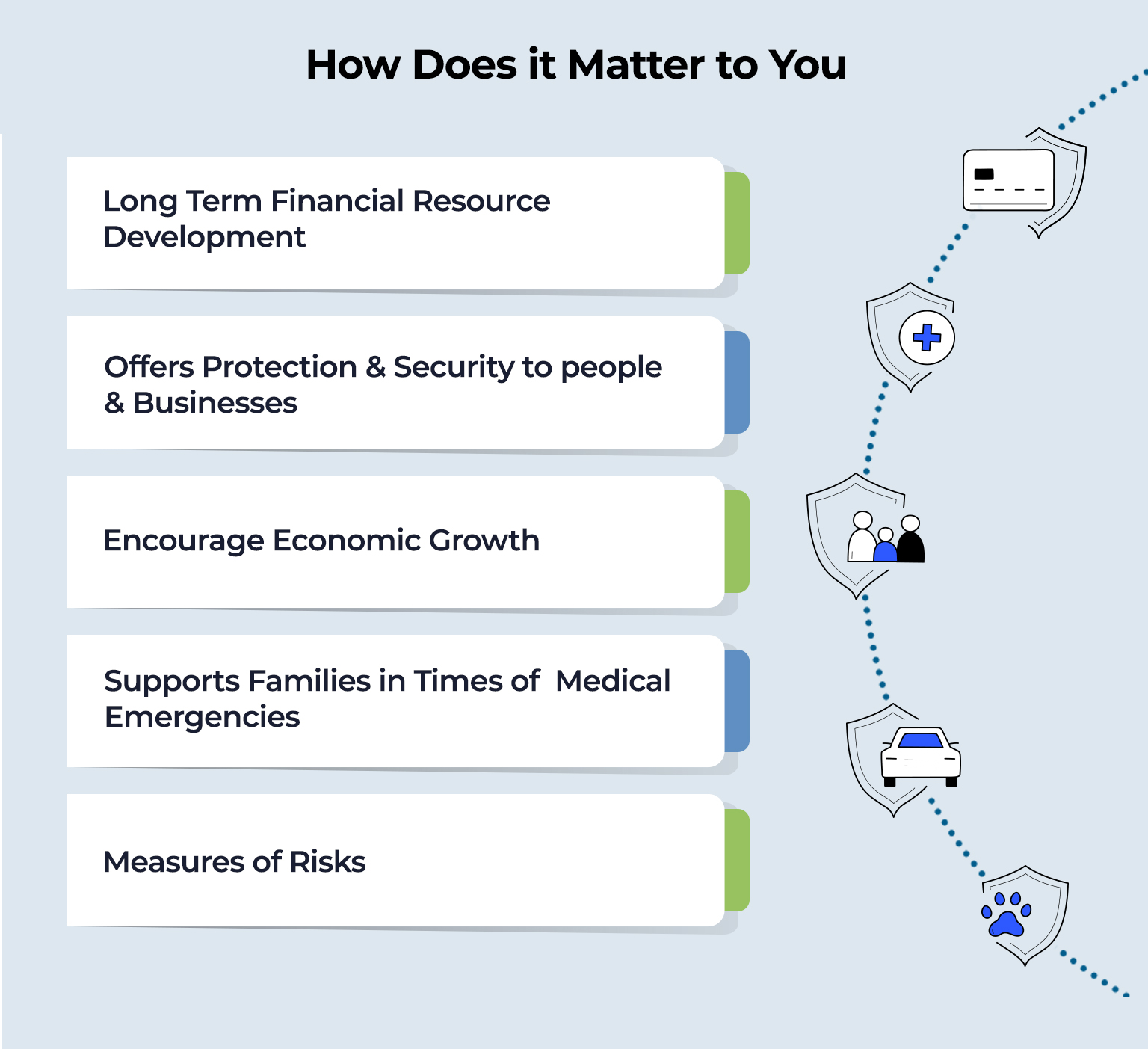

How Does it Matter to You

Without insurance, any occurrence would exhaust your funds, but insurance would pay for all unforeseen financial losses brought on by an unfortunate incident. By shifting your financial risk to an insurance provider, having enough insurance lowers your risk. Risks can be to a person’s life, possessions, health, or any other asset, leading to financial losses.

Here are some Insurance Importance:

How Insurance Disability Benefits can be Managed?

Before we talk about how to handle the Insurance Business Disability Benefits, let’s talk about what they are:

The administration of employee disability benefits is essential to a complete employee benefits plan. This toolbox looks at the different types of disability benefits that an employee might be able to get. This part looks at other employee perks that, in addition to the usual short-term and long-term disability benefits, may also count as disability benefits. This list includes leave benefits and different ways to compensate for lost income. In some cases, it also has benefits that help with disabilities.

This toolkit also looks at how disability benefits affect both employees and companies and what HR’s role is in managing them. It gives advice on how to handle different types of benefits, such as how to decide who is eligible, how to balance the types of benefits offered, how to determine whether an organization should handle its own advantages or hire a third-party administrator, how to tell employees about these benefits and how effective they are.

To summarize, disability benefits are an employee benefit that helps employees who are sick or hurt and can’t work/replace their income and/or keep their jobs. These limits could be temporary or last for a long time.

Types of Disability Benefits

A number of benefits fall under the general term “disability benefits.” The most known types are short-term and long-term. However, other types of insurance, like long-term care, workers’ compensation, and paid leave policies, can also help employees if they get sick or hurt.

1. Short – Term Disability Insurance

Short-term disability insurance covers an employee’s pay for a short time if they can’t do their job duties because of serious health problems, like an injury or illness. This insurance covers between 40 and 70% of their salary. Depending on the situation, an employee’s coverage could last anywhere from a few weeks to a whole year.

Only a few states, like New York, California, and Rhode Island, require businesses to give all employees short-term disability insurance, whether they get it through a private company or a state-run program.

2. Long – Term Disability Insurance

Long-term disability insurance protects employees’ pay by covering about 60% of their gross monthly income over the long term. Long-term disability is for people who can’t do any work, not just the one they have now. The length of coverage could be anywhere from two years to the start of Social Security benefits or retirement.

Some qualifying injuries and illnesses are cancer, mental illness, arthritis, back problems, stroke, and other severe conditions that make it hard for employees to do their daily jobs.

3. Long Term Care Insurance

Long-term care insurance covers chronic illnesses and disabilities that can be treated outside of a hospital and leave a person unable to take care of themselves. Some of these services are home health care, respite care, adult day care, nursing home care, hospice care, and care in an assisted living facility. Long-term care insurance is bought by a family to protect their finances.

4. Critical Illness/Supplemental Insurance

Under critical illness and supplemental insurance policies, when an employee is diagnosed with one of the conditions listed in the policy, they get a set amount of money all at once. Even though “cancer” insurance is common, it can also cover things like stroke, heart attack, and kidney disease.

5. Employer Support/ Patient Navigators

Employers can help workers with chronic or long-term diseases by setting up programs to help them figure out health insurance, disability benefits, and treatment options, which can be hard to understand after a diagnosis.

Role of Beyond Key in the future of Insurance Business

The insurance sector is a data-driven one. Every day, more players join the race, and each one of them has access to a wealth of data. However, only those who can spin that data into insightful knowledge can turn it into a gold mine.

Beyond Key helps various other insurance companies in order to assist them with “Solutions for Effortlessly Submitting Insurance Claim Requests.”

Key Attributes of Beyond Key Related to Insurance Domain:

- Innovators in the field of insurance process automation and policy tracking.

- Using platforms for insurance software to enable high performance insurance.

- Involved in Seamless integration of old systems and applications.

- Utilizing the expertise of more than 80 insurance software development specialists

When it comes to Insurance, there are several capabilities and offerings that Beyond Key reflects, and these are:

Reasons why your Insurance Business needs Beyond Key’s assistance

Decision-making, business intelligence, customer conversion, and other processes have significantly improved for insurance businesses employing Beyond Key Services.

Here are some advantages to it:

1. Accurate Risk Prediction for Underwriting:

1. Accurate Risk Prediction for Underwriting:

By adding Beyond Key Services to the insurance underwriting process, algorithms can do extra work so that underwriters can focus on tasks that require judgment and intuitive decision-making. Using Beyond Key Services, better rules for underwriting can be made. So, underwriting procedures are always followed the same way, and risks are cut down.

2. Combating Claim Fraud

Many Insurance Organizations use Beyond Key Tech Services to quickly and accurately find fraudulent insurance claims. For example, an insurance company’s data trends keep track of the history of fraudulent claims. This lets the insurance company look at any claim to see if the trend is repeated. In turn, this makes fraud less likely to happen.

3. Facilitating Business Growth

One of the most important parts of the insurance field is figuring out how to measure risk levels to help companies grow. Before, this business-critical risk was mostly calculated by intuition and guesswork. So, insurance companies can use this information to find and stop revenue leaks that could hurt the company’s ability to make money. Insurance data analytics helps insurance firms grow because of how much it can do.

4. Increasing Lead Generation

Insurance companies can use Beyond Key’s Data Analytics-enabled platforms like CRM and Business Management Systems to get useful information from reports that show the customer journey from search to conversion. It helps them understand how customers act and gives the marketing department the ability to send the right message to pre-warming leads.

5. Increasing Client Satisfaction

If an insurance company can predict the needs of potential clients by looking at data patterns, it has a much better chance of making a sale than if it only uses traditional sales methods. Analyzing customer data can also advise how to make customers happier.

6. Efficient and rapid claim processing and settlement using chatbots powered by AI

Beyond Key provides various insurance companies with AI-powered chatbots to improve the client experience. With these chatbots, claims settlement can be rapidly done up to 70% to 80%. This will also help insurance companies to make their grade up and also helps other customers who choose to move to another brand have a negative experience with the claim settlement process

Technology Stack Used by Beyond Key to Provide Services in the Insurance Business Industry

These are a few of the technologies that Beyond Key makes use of.

Conclusion

Conclusion

Up-and-coming leaders in the insurance industry use analytics linked to insurance data and other related technologies to make decisions about pricing strategies and risk selection.

For insurance transaction data like underwriting, insurance claims, customer satisfaction, and policy administration, the new technology is gradually deploying prescriptive ways to get deep insights from Beyond Key’s Services to improve organization performance and decision making.

Because of this, insurance companies can use analytical thinking in all of their business and internal operations.

In this way, Beyond Key helps a lot of insurance companies. As digital channels become more popular, more and more customers choose self-service portals for quick access and immediate answers to their constantly changing financial and protection needs.

1.

1.